Introduction

Back in 2015, the Commission has adopted its first Action Plan on Building a Capital Markets Union (CMU), whose main aim was to start the process of creation of a single capital market in the EU that would reduce existing market fragmentation and mobilise more funds for capital markets based financing of European businesses. Almost 5 years after publication of its first Action Plan, in September 2020 the Commission has unveiled its revised Action Plan on CMU, which was tailored in accordance with new economic priorities of the EU, recovery from the economic crisis caused by the coronavirus pandemic and transition to a digital and sustainable economy.

By a way of delivering on its commitments from the revised Action Plan, the Commission has published on 25 November 2021 a package of four legislative proposals that aim to contribute to achieving the CMU objectives and boost European capital markets.

The package contains the following legislative proposals:

- Regulation establishing a European Single Access point (ESAP)

- Regulation amending Regulation on European long-term investment funds (ELTIF)

- Directive amending the Alternative Investment Funds Managers Directive (AIFMD) and UCITS Directive

- Regulation amending the Markets in Financial Instruments Regulation (MiFIR)

The main proposals contained in these proposed legislative acts can be summarised as follows:

The European Single Access Point

With the idea of creating a common source of public information about EU companies and investment products, the European Securities and Markets Authority (ESMA) shall establish the European Single Access Point (ESAP) by 2024. The information that will be publicly accessible on the ESAP will be collected by designated collection bodies and will be accessible through a single application-programming interface (API). By providing data in digital format (data extractable or machine-readable format), the ESAP is intended to be a cornerstone of the EU Digital Finance Strategy that would enable planned transition to data-driven finance.

Further, when it comes to existing EU policy on sustainable growth (anchored in the EU Green Deal and the Sustainable Finance Strategy) companies in the EU are currently faced with significant challenge of how to obtain relevant ESG information based on which they can ensure their compliance with relevant rules on corporate sustainability reporting or financial sustainability disclosure requirements. To that end, the ESAP shall also serve as a centralised access point for all ESG data of EU companies and information on ESG related financial products with a great potential to boost the green transition.

Review of the ELTIF Regulation

Back in 2015, the first Regulation on European-long-term investment funds (ELTIFs) was published with the aim to enable channelling of long-term financing to listed and non-listed small and medium enterprises as well as long-term infrastructure projects in the EU. Despite the ambitious plan behind it, the Regulation did not seem to have achieved much so far: the number of ELTIFs in the EU remains relatively small with only 57 funds authorised by October 2021 in only four EU Member States.

The proposed amendments aim to make the ELTIF framework more attractive for the fund management industry by expanding the range of eligible investment assets and making necessary amendments to authorisation, operational and marketing requirements. Further, specific regime for ELTIFs that are to be marketed to professional investors, featured by new rules on portfolio diversification and composition, minimum threshold for eligible assets and concentration limits, will be introduced. The existing minimum investment threshold of EUR 10 000 shall also be removed to enable easier access to ELTIFs for retail investors.

Review of the AIFMD and UCITS framework

More than a year after the ESMA has sent its letter to the EU Commission with 19 key areas of improvement for AIFMD framework, the EU lawmaker has published a long-awaited proposal for the revision of the AIFMD (Directive 2011/61/EU). Focused on establishing similar rules in certain areas for both AIFs and UCITS, the proposal makes some amendments to UCITS Directive (Directive 2009/65/ec) as well that largely follow amendments to AIFMD framework.

The proposal makes changes to AIFMD and UCITS framework in several areas that include, among other, the following:

- Loan originating funds

Rules on loan originating AIFs will be harmonised to ensure a uniform level of investor protection and create a level playing field for loan originating AIFs in the EU. To that end, AIFMs that manage AIFs engaging in lending activities will need to comply with additional requirements on risk management and conflict of interest as well as risk-retention requirements when it comes to sale of granted loans in the secondary market. In the future, loan originating AIFs whose notional value of their originated loans exceeds 60 % of their net asset value, will need to be structured as closed-ended funds.

- Delegation arrangements

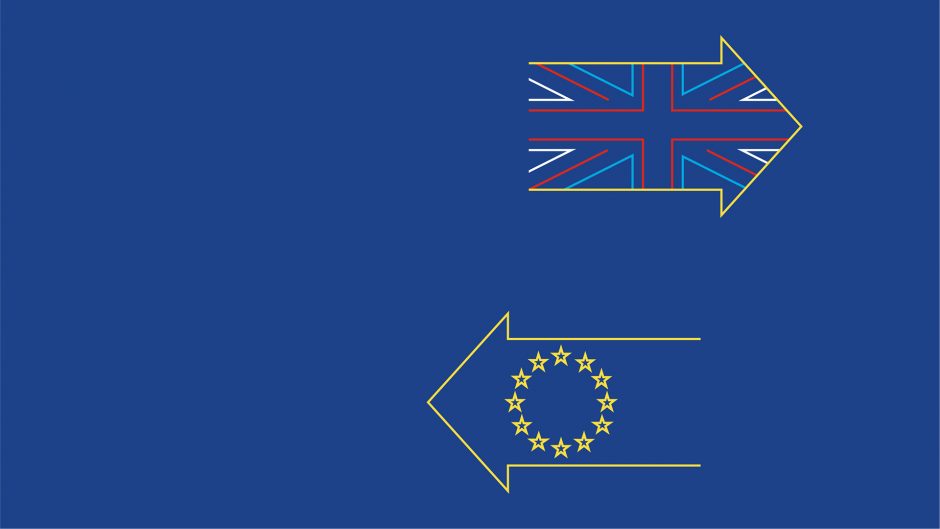

The proposal clarifies that all activities listed in Annex I of the AIFMD (Annex II of the UCITS Directive) can be subject to delegation and the revised language is now referring to services and not only functions (like portfolio management or risk management). The new framework will continue allowing sourcing of expertise from third countries based on delegation arrangements, which certainly comes as a relief for the fund management industry after years of discussion on how the future of delegation arrangements will look like in the post-Brexit world. Further, NCAs will be required to notify ESMA about delegation arrangements where more risk or portfolio management function is delegated to third country entities than retained by an EU-AIFM.

- Substance requirements

Fund managers applying for authorisation under AIFMD or UCITS framework will need to have appropriate technical and human resources and will need to describe in detail in their license applications how these resources will be used to carry out their functions and supervise the delegates. Further, in order to meet minimum substance requirements, all AIFMs and UCITS management companies will have to employ at least two persons (or engage two persons on a contractual basis) who are residents in the EU on a full-time basis.

Due to their significance and comprehensiveness, we will elaborate the changes introduced to AIFMD and UCITS framework in a separate publication in which we will also analyse their practical impact on the fund management industry in the EU.

Consolidated Tape

Through targeted amendments of the backbone of the EU market infrastructure regulation, MiFIR, the Commission intends to introduce a long-awaited consolidated tape that would provide access to data on prices and volume of traded securities in the EU. Currently, only a handful of large professional investors have access to near real-time market data across trading venues.

The introduction of a consolidated tape shall enable all investors, both large and small, the access to consolidated data on prices and volume for several asset-classes, such as shares, exchange-traded funds and bonds. The relevant market data will need to be submitted by market operators to consolidated tape provider (entity authorised under MiFID II) and Member States are required to provide for sanctions for entities not operating in compliance with this rule.

Ban of the Payment for order flow (PFOF) practice

The package also includes a Regulation that introduces a ban of the widely discussed and criticized market practice used by many new online brokers nowadays, payment for order flow (PFOF). Namely, for several years now, many new online brokers that promote the “zero-commission policy” (also referred to as “neo-brokers”) have been building their business models on the PFOF practice. When relying on the PFOF, an online broker routes his clients’ orders to a market maker for execution and receives a fee in exchange for this.

The PFOF was an area of concern of the EU regulators for quite some time now, and the Commission has expressed its concerns that brokers’ reliance on PFOF may lead to retail orders not being executed on terms most favourable to the client but instead on the terms most profitable to brokers. The published proposal is now prohibiting all investment firms operating in the EU, who act on behalf of clients, from receiving any fee, commission or non-monetary benefit from any third party in exchange for forwarding them client orders for execution.

We will analyse this important topic, which promises to have a significant impact on businesses of many neo-brokers in the EU, in a separate article in more detail.

Outlook

The published proposals represent important milestones on the way towards creating a Capital Markets Union for Europe and will definitely have an impact on existing business of many firms in the financial services sector. The Commission is planning to deliver on all of its commitments from the Action Plan until the end of its term, and is planning to present further legislative proposals in 2022 on open finance and listing rules as well as proposals creating frameworks on corporate insolvency and financial literacy.